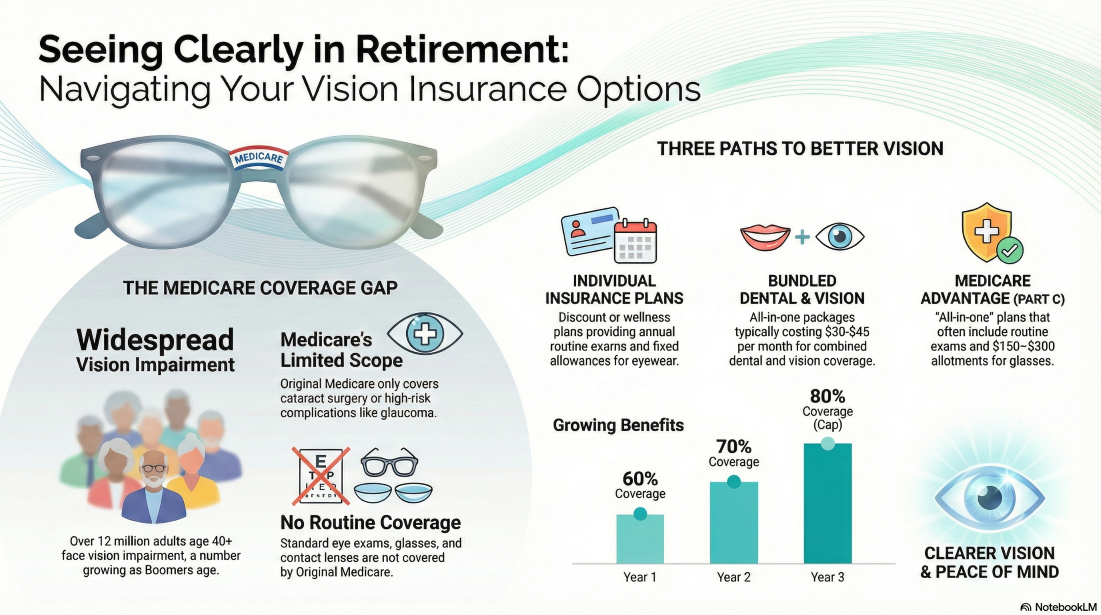

Vision Insurance For Retirees

If you’re a retiree or approaching retirement you probably remember Johnny Nash singing I can see clearly now the rain is gone I can see all obstacles in my way. Gone are the dark clouds that had me blind. It's gonna be a bright, bright, sunshiny day. And that’s exactly what today’s retirees want. It’s just fact that as [...]

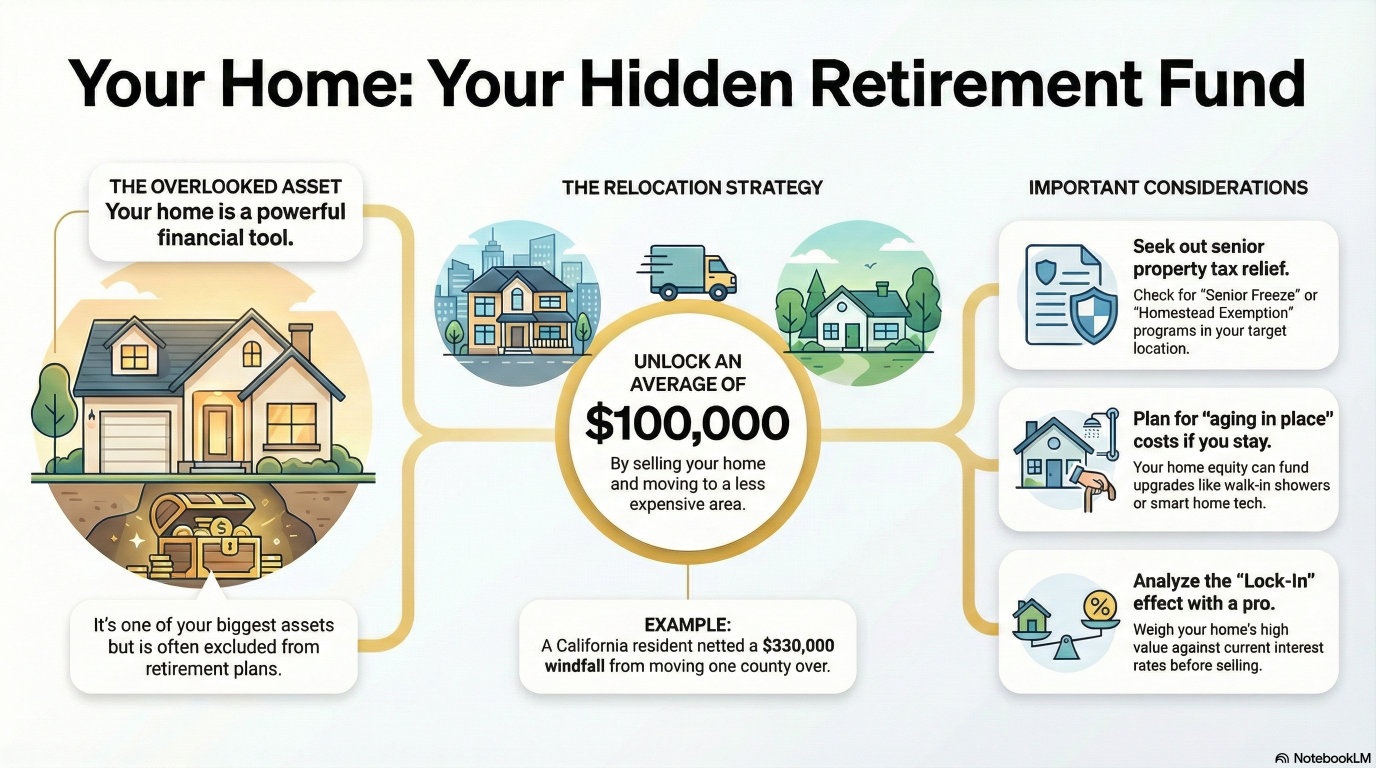

Don’t Exclude Your House from Retirement Planning

Planning for retirement includes a cornucopia of facts, details and speculation—when do you want to retire, how much will it cost for the lifestyle you want, how long do you think you’ll live—all important considerations. The money can come from a long list of possibilities—a 401(k), IRAs, non-retirement investments, and Social Security. Oddly enough, one of the biggest assets [...]

2026 Retirement Plan Contributions

What’s going to happen in 2026? If I could wave my hands over a crystal ball or rub a magic lamp, I’d tell you. Unfortunately, that stuff only works in the movies. But even though I’m not a sage or sooth-sayer with mystical powers, I do have guaranteed information you can take to the bank. And what is this beneficial [...]

No Tax on Your Required Minimum Distribution

Here it is, the end of the year, and you may be faced with that pesky government requirement that forces you to take money out of your IRA whether you want to or not. The distribution is considered ordinary income and you pay taxes on that amount at your tax rate. If you don’t, you’ll end up paying an excise [...]

Year-End Financial Checklist For 2025

When you look back over the previous 12 months, you might be surprised at what may have changed for you, whether in terms of the economy at large, your individual finances, or your personal circumstances. That’s why the end of the year is a great time to reflect and to prepare for the year ahead. Maybe you want to pay off [...]

Retirement Account Contribution Limits for 2025

Still looking for ways to keep the IRS’s hand out of your pocket at tax time? If so, you still have time to make the maximum retirement plan contributions for 2025. Every $100 of deductions you gather now can reduce your federal tax bill by up to $37 next April. Here are some possibilities. For 2025 you can contribute [...]

Yep, Medicare is Going Up in 2024 Too

Well, it’s that time of year again when leaves change color and the federal government tells you how much more Medicare will cost you next year. The Bureau of Labor Statistics (BLS) says that 13% of spending by the typical senior goes to healthcare. For 2024, folks with Original Medicare will see increases to all premiums and deductibles. Medicare [...]

Retirement Account Contribution Limits for 2024

You get to save more in your retirement accounts in 2024. The IRS has made its inflation calculations and announced the new adjusted contribution limits. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan increases to $23,000, up from $22,500 in 2023. For individuals 50 and older, the [...]

2024 Social Security Cost of Living Adjustment

There are two important days every year for people on Social Security—the day they find out how much their checks will go up because of the annual Cost-of-Living-Adjustment (COLA), and the day they start getting the extra money. October is the month they find out how much. Automatic Social Security Cost-of-Living Adjustments have been in effect since January 1, [...]

Stay In Touch