4 Dangerous Estate Planning Myths (VIDEO)

Estate planning is essential, but there are four myths that can defeat your intent.

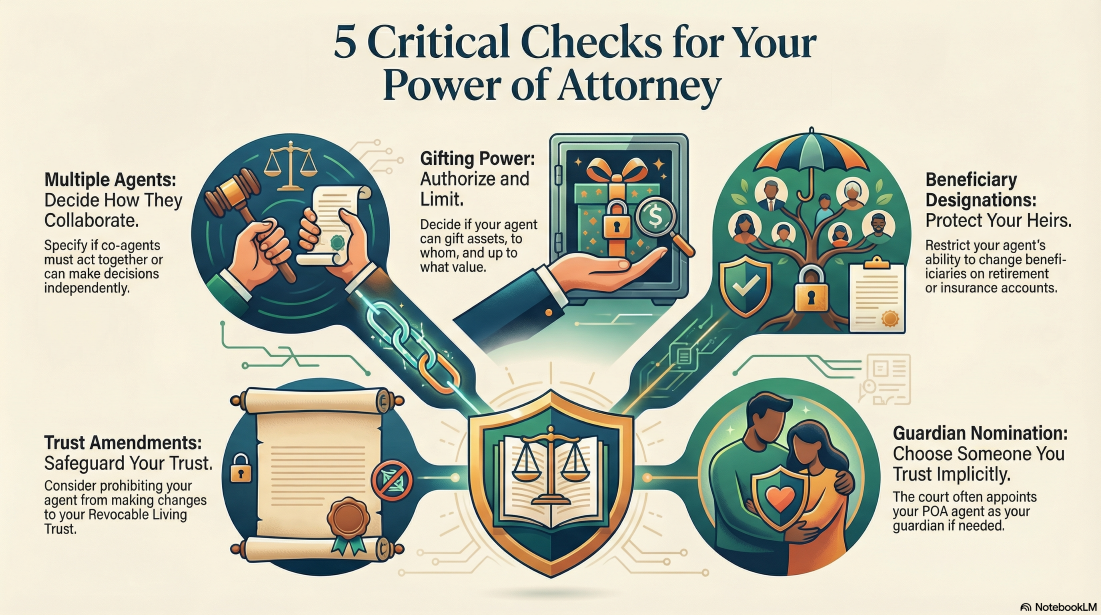

5 Critical Checks for Your Power of Attorney

How many times have you seen articles reminding you how important it is to have a power of attorney (POA) document in place just in case something happens and you can’t care for yourself or make your own decisions. Absolutely, you need a POA. But make sure it’s structured correctly. The attorney who drafts your POA most likely uses [...]

Choosing the Right Trustee: A Guide

So, you’ve decided a Trust is the best way to protect your legacy. Congratulations! You’ve done the hard work of deciding what goes where. Now comes the part that feels a bit like casting a lead role in a high-stakes Broadway show: Choosing the Trustee. This person (or institution) will hold the keys to the kingdom. They aren't just [...]

The Catastrophe of Having the Wrong Beneficiary

Do you want your ex-spouse to get your money when you die? Or how about someone that’s fallen out of your good graces? No matter what your will says, the name(s) on the beneficiary form you signed is written in stone. And if you forgot to name a new beneficiary after a change in family status, somebody is just plain [...]

Tis the Season—to Check Those Beneficiaries

Do you want your ex-spouse to get your money when you die? Or how about someone that’s fallen out of your good graces? No matter what your will says, the name(s) on the beneficiary form you signed is written in stone. And if you forgot to name a new beneficiary after a change in family status, somebody is just plain [...]

What to Know About Gifting in 2025 & 2026

Gifting: Definition The transfer of assets, such as cash, investments or property, from one person to another without receiving anything in return, often with the intent of helping the recipient with financial goals like education, buying a home, or investing. Gifting can also have tax implications for the donor. Gifting is a highly effective estate planning tool that has [...]

Year-End Financial Checklist For 2025

When you look back over the previous 12 months, you might be surprised at what may have changed for you, whether in terms of the economy at large, your individual finances, or your personal circumstances. That’s why the end of the year is a great time to reflect and to prepare for the year ahead. Maybe you want to pay off [...]

Charitable Giving Strategies You Can Still Use In 2025

It’s always a great challenge to find all possible deductions that will make your tax bill as small as possible. This late in the year you may have thrown up your hands and asked, “What else can I do?” But take heart. There are still several strategies available if you are charitably-minded. Appreciated assets If you itemize deductions on [...]

Qualified Charitable Donations (QCD) from Inherited IRAs

At the very moment IRAs joined the retirement savings universe in 1974, so did Required Minimum Distributions (RMD). The government was more than happy to provide a tax-deferred way to save for the future, but it came with a future reckoning—paying taxes on all the contributions and on all future growth whenever an IRA owner began to take distributions. And [...]

Stay In Touch