What is My Social Security Break-Even Age?

There’s an old axiom that says nothing in life is certain except death and taxes. True enough. But there’s one other thing that’s certain; we’re all going to retire—sometime. The number one retirement question I’m asked is, “What is the perfect age to retire?” Close on its heels is, “When should I start taking Social Security?” The Social Security question [...]

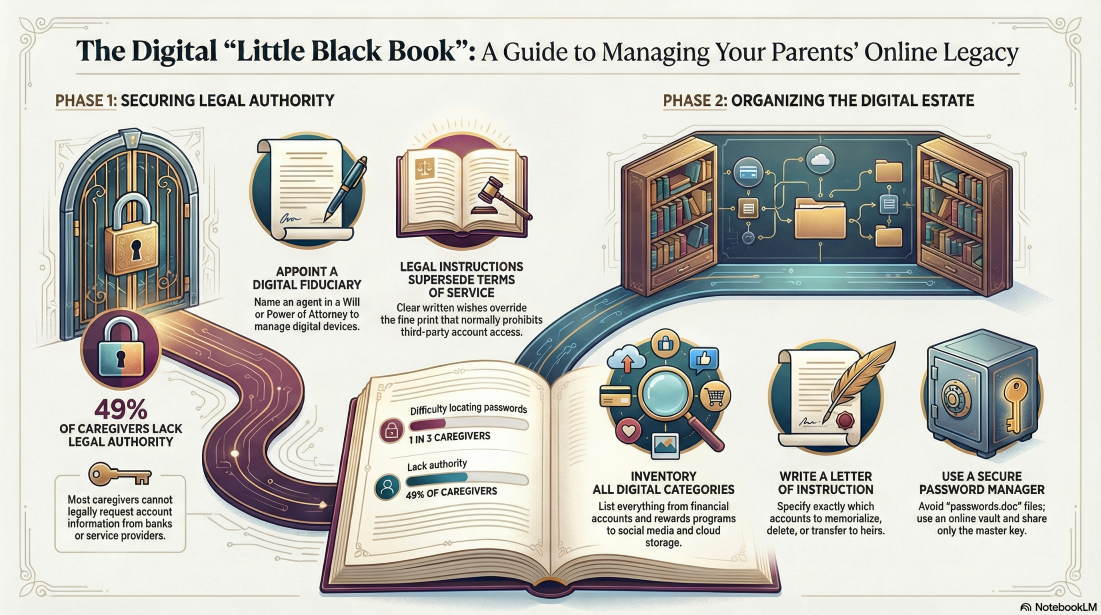

Encourage Mom and Dad to Keep a Little Black Book

For those of us who’ve lived a while, we remember the “little black book”—the place you kept important contact information before the technology revolution. If you’re caring for elderly parents or you think that’s a possibility, encourage mom and dad to keep a little black book, not for dating purposes, but to help you take care of them in this [...]

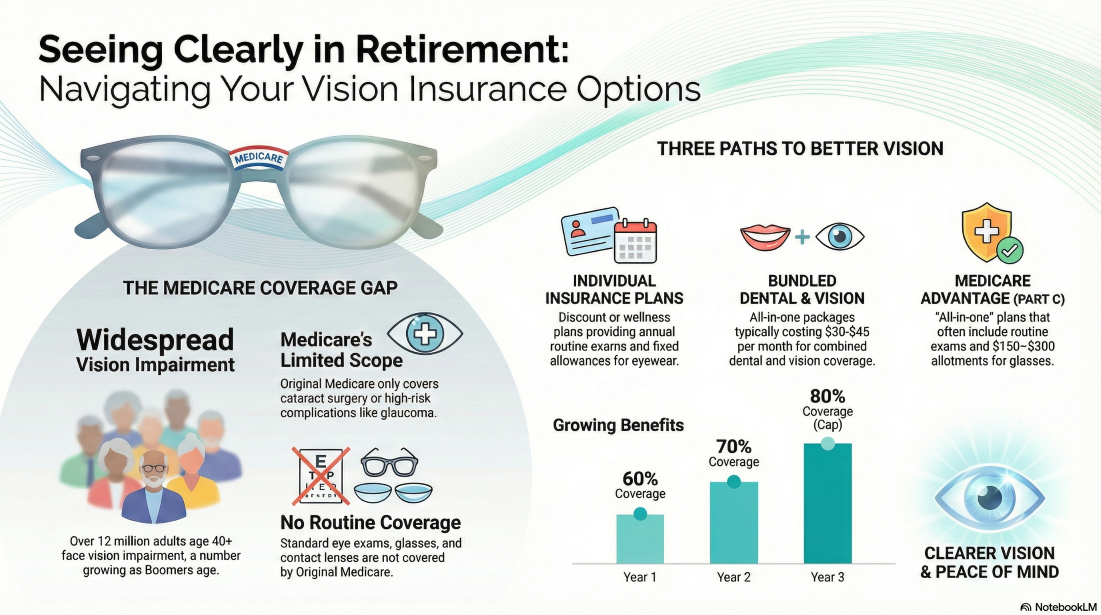

Vision Insurance For Retirees

If you’re a retiree or approaching retirement you probably remember Johnny Nash singing I can see clearly now the rain is gone I can see all obstacles in my way. Gone are the dark clouds that had me blind. It's gonna be a bright, bright, sunshiny day. And that’s exactly what today’s retirees want. It’s just fact that as [...]

10 Social Security Mistakes That Can Devastate Retirement Income

Social Security, even with all its problems, is unquestionably an important component of retirement income for millions of Americans. For about half of seniors, Social Security is 50% of their income, and 1 in 4 seniors say it makes up at least 90% of their income. There are more parts to Social Security than most people realize. Only in [...]

4 Dangerous Estate Planning Myths (VIDEO)

Estate planning is essential, but there are four myths that can defeat your intent.

Calculate Early Social Security (VIDEO)

Taking Social Security before full retirement age reduces your benefit permanently. Here's how to calculate how much you'll get.

Stay In Touch