Most investors fall into one of two camps – value or growth. Value investors buy stocks that are cheap based on fundamental measures such as Price/Sales, Price/Earnings, or Price/Book Value. Growth investors are not as concerned about price, focusing mostly on the rate of growth of revenue and earnings.

Through history, the two styles have enjoyed alternating periods of outperformance but their long-term returns are remarkably similar. Outperformance by one style is inevitably followed by outperformance by the other. Most recently, it has been growth’s time in the spotlight, outperforming value over the last 10 years by almost 3 to 1. While we can’t say when value will take the lead, we feel confident in saying that it will.

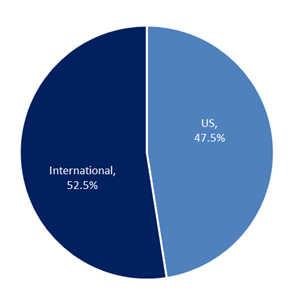

US and non-US markets also go through alternating periods of outperformance, US outperformance inevitably followed by international outperformance. Over the last 10 years, US stocks outperformance of international stocks is almost exactly the same as US growth’s outperformance of US value stocks.

Quantitative Modeling

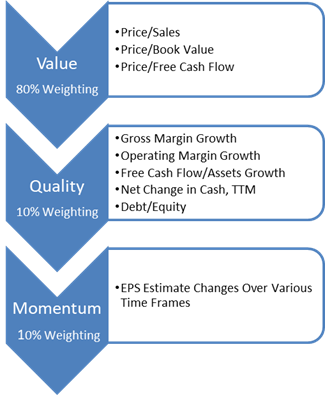

The Global Value portfolio is an all-cap global portfolio of stocks with classic value characteristics. The portfolio construction process starts with a global universe of all stocks listed in the US, including ADRs and foreign stocks listed in the US. The stocks are ranked using our Value-Quality-Momentum ranking system:

Stocks must be in the top 10% of ranked stocks to be included in the portfolio. Stocks must also have a minimum market cap of $1.5 billion and have sufficient trading volume. A limit is placed on the maximum number of stocks in each sector.

Sell Discipline

Stocks are sold from the portfolio when their rank falls out of the top 20%.

Portfolio Construction & Characteristics

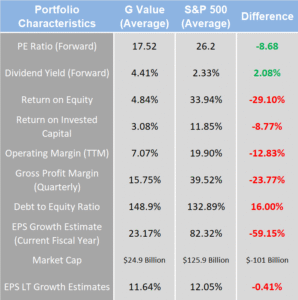

The portfolio currently holds 50 stocks, out of a maximum of 50, with the following fundamental profile: (as of 10/17/25):

Stay In Touch