The Citadel Portfolio is a more active, tactically-managed version of our Fortress Portfolio. The Citadel Portfolio, the end result of our extensive research on the global economy, is designed to grow wealth in a structure that prioritizes consistency and security. The strategic framework of the Fortress Portfolio provides a more dependable result than the traditional stock and bond portfolio, while tactical adjustments seek to improve on the already impressive Fortress track record.

- Minimum investment of $250,000

- Uses low-cost index ETFs and some actively managed funds

- Calibrated to fit the current economic environment

- Backed by years of historical research

Our Fortress Portfolio, the basis for all our asset allocation portfolios including Citadel, has 5 asset classes and 6 distinct assets:

> Large Company Stocks – S&P 500 Index (SPY, IVV)

> Small Company Stocks – CRSP Small Cap Value Index (VBR) or S&P 600 Index (IJR)

> Real Estate – MSCI US Investable Market Real Estate Index (VNQ)

> Commodities – S&P GSCI Commodity Index (GSG, COMT, PDBC)

> Gold – Spot Gold Price (IAU, GLD)

> Bonds – Bloomberg 3-10 Year US Treasury Index (VGIT)

Fortress portfolios are passive and once constructed they aren’t altered for market or economic considerations.

The Citadel Portfolio takes a different, more active approach. Each asset class is actively managed and can consist of multiple investment vehicles. Cash can be used in any asset class that is deemed unattractive but no asset class will fall below 50% of the strategic allocation.

Tactical changes are determined through observations of the global economy and markets. We use two categories of indicators to judge the economic environment:

Interest Rates

Currencies

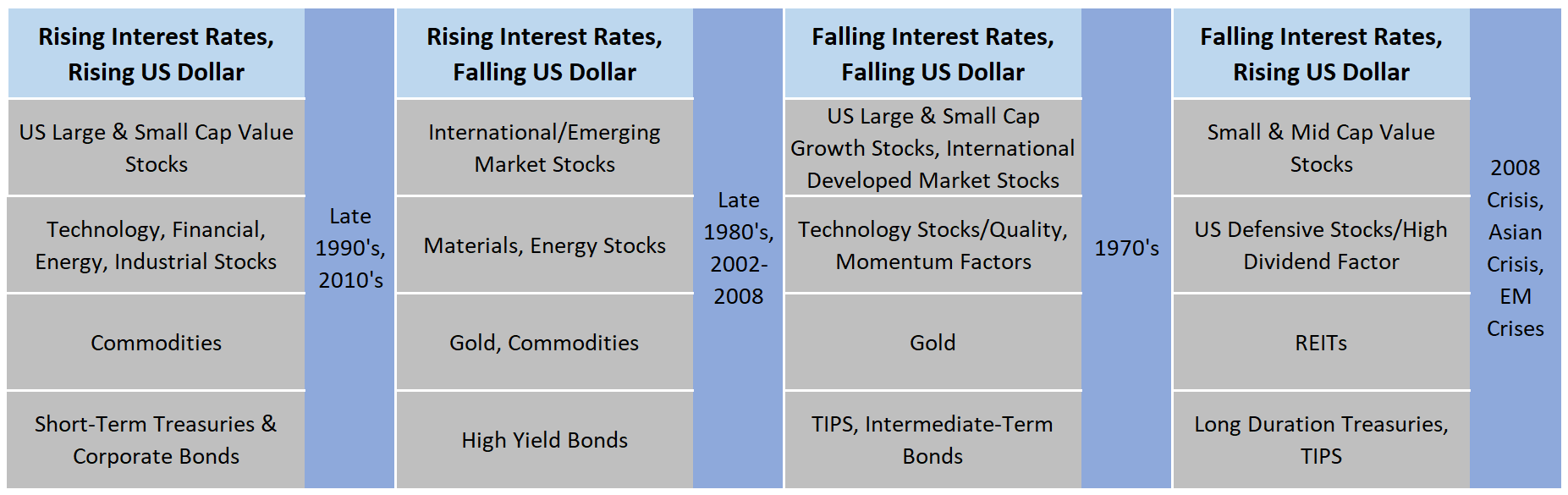

Based on extensive historical research, we identify assets that perform well in each of four economic environments:

The result is a widely diversified portfolio that still follows the Fortress framework but is modified to fit current conditions. It is this combination of a diversified strategic plan and intelligent tactics, that together produce a dynamic, tactically-adjusted Citadel Portfolio.

Stay In Touch